In the healthcare industry, where margins continue to tighten and administrative burdens continue to increase, effective payer negotiations have become essential for providers. Many providers leave significant revenue on the table simply because they lack the data, strategies, and experience to secure optimal reimbursement rates from insurance companies.

The hidden revenue opportunity in contract negotiation

Healthcare providers across the United States are facing similar challenges when it comes to negotiating payer contracts. Despite delivering high-quality care, many find themselves accepting suboptimal reimbursement rates that don’t reflect the true value of their services.

According to recent surveys, the disparity in reimbursement rates for identical services across different payers can vary by up to 300%. This wide variation represents a significant opportunity for providers who approach contract negotiation more strategically.

Why traditional contract negotiations fall short

Many healthcare organizations take a reactive approach to payer contract negotiations, only reviewing terms when contracts are up for renewal or when reimbursements become problematic. This passive strategy puts providers at a strong disadvantage.

Common pitfalls in the contract negotiation process include a lack of comprehensive data on market rates and benchmarks, insufficient preparation and analysis before meetings, limited understanding of contract language and implications, inadequate leverage when dealing with large insurance companies, and an inability to effectively quantify and demonstrate the value providers bring to the table.

These shortcomings often leave healthcare organizations at a significant disadvantage when attempting to secure fair reimbursement rates.

Forward-thinking providers are now recognizing that successful negotiation in contract planning requires a more systematic, data-driven approach.

The power of data in negotiating reimbursement rates with insurance companies

The foundation of effective payer contract negotiations is robust data analysis. Without concrete evidence and precise metrics, providers enter negotiations in a weak position.

Here’s how data transforms the negotiation dynamic:

1. Data establishes accurate baselines

Before entering any discussion about negotiated fee schedules, providers must understand their current financial relationship with each payer. Examples of data to analyze include:

- Current reimbursement rates across all payers: These identify disparities and opportunities for negotiation.

- Service volume by CPT codes: This quantifies which procedures generate the most significant revenue and where rate improvements would have the greatest impact.

- Revenue distribution by payer: This determines which insurance relationships are most critical to the practice’s financial health.

- Performance against quality metrics: This demonstrates value and supports arguments for higher reimbursement rates during negotiations.

Without this detailed self-assessment, providers enter negotiations with incomplete information, potentially missing opportunities to address specific pain points or failing to recognize their strongest bargaining positions when discussing new terms with payers.

2. Data provides benchmarks on market rates

One of the most powerful tools in negotiating fee schedules with insurance companies is market comparison data. Providers need to understand not just their own rates, but how those rates compare to the following:

- Regional averages for similar providers: These offer crucial comparative data that establishes local competitive standards and helps justify requested increases.

- Rates for similar specialties nationwide: These broaden the context for what constitutes fair compensation across different geographic markets.

- Medicare rates: These give an industry-standard reference point for baseline comparisons, even though commercial reimbursements typically exceed government-established rates.

- Rates achieved by comparable practices with similar patient demographics and service offerings: These demonstrate what is realistically attainable and help set ambitious yet reasonable targets for negotiations.

Understanding the competition is essential when making the case for rate increases.

3. Data showcases payer profitability

Sophisticated contract negotiation strategies should incorporate an understanding of the payer’s business model. Analysis of Medical Loss Ratio (MLR) data, payer financial statements, and market share information can reveal which payers have the most flexibility to increase rates.

When providers understand this important data, they can discern which payers should be prioritized for negotiation.

Building a compelling case for rate increases

Armed with comprehensive data, providers can construct persuasive arguments for why their negotiated rates should increase. Effective cases typically:

1. Demonstrate value

Document and quantify the value you bring to the payer’s network through quality metrics and outcomes data, patient satisfaction scores, cost efficiency compared to similar providers, and unique services or capabilities in your market.

2. Justify the financials

Present clear financial analysis that demonstrates the gap between your current rates and market benchmarks, rising costs of providing care (staffing, supplies, technology), how requested increases align with reasonable market expectations, and the financial impact of maintaining the status quo.

3. Highlight what matters

Emphasize your importance to the payer’s network by highlighting patient volume and geographic coverage, specialties and services unique to your practice, referral patterns and relationships with other providers, and patient retention and loyalty metrics

Executing effective contract negotiation strategies

Once prepared with the appropriate data and talking points, providers must implement a strategic negotiation plan. Expert contract negotiation consultants typically recommend:

1. Strategic preparation

Strategic preparation requires establishing clear objectives and walkaway positions, identifying decision-makers within the payer organization, research the payer’s negotiation history and tendencies, and developing multiple proposal options with varying terms.

2. Effective communication

Effective communication requires presenting data visually for maximum impact, focusing on mutual benefits rather than demands, using simple language to explain complex financial analyses, and maintaining professional relationships throughout the process.

3. Persistent follow-through

Persistent follow-through requires documenting all discussions and agreements, following up promptly on information requests, maintaining momentum throughout negotiations, and being prepared to escalate to higher-level executives when necessary.

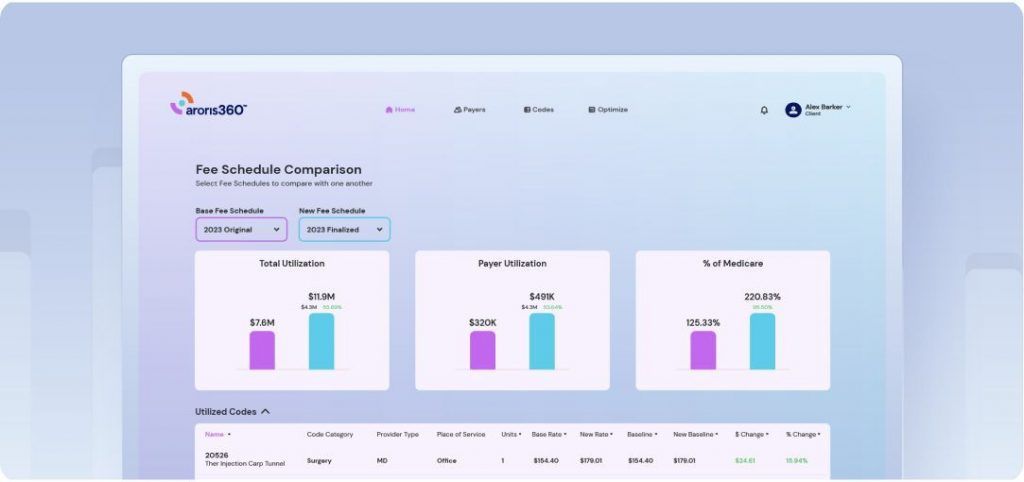

Leveraging technology for negotiating health insurance contracts

Modern healthcare payer contract negotiations increasingly leverage specialized software platforms and analytics tools. These technologies enable real-time analysis of contract performance, modeling of different rate scenarios and their financial impact, tracking of contract versions and proposed changes, and visualization of complex data for negotiation presentations.

Such tools can level the playing field when negotiating insurance reimbursement rates with large payers that have sophisticated analytics at their disposal.

When to consider negotiation services

While some organizations successfully handle payer negotiations internally, many find value in partnering with specialized contract negotiation services.

Consider this approach when:

- Your team lacks specialized expertise in insurance contract analysis

- Previous negotiation attempts have yielded limited results

- You’re facing particularly challenging payer relationships

- Internal resources are stretched too thin for thorough preparation

- You need access to proprietary market benchmarking data

Professional payer contract negotiation services bring not only expertise but also valuable market intelligence and relationships that can accelerate results.

Aroris360 can help. Learn How

Maintaining contract negotiation success long-term

Securing better contract reimbursement rates isn’t a one-time achievement but an ongoing process. To be successful over the long haul, sustainability is key.

Long-term success requires:

- Regular contract performance monitoring

- Continuous data collection and analysis

- Proactive relationship management with payers

- Consistent documentation of quality and performance metrics

- Periodic review of competitive market position

By establishing these disciplines, providers can maintain favorable payer contract negotiations year after year.

Taking the next step in contract negotiations

For healthcare providers facing challenging financial pressures, improving and negotiating payer contracts represents one of the most direct paths to increased revenue. Unlike many other revenue enhancement strategies, better contract terms flow directly to the bottom line without requiring additional staff, equipment, or patient volume.

By investing in data analysis, strategic preparation, and effective negotiation techniques—either internally or through specialized insurance contract negotiation services—providers can secure reimbursement rates that fairly reflect the value they deliver.

In today’s complex healthcare environment, leaving contract terms to chance is no longer an option. Providers who embrace data-driven payer negotiation strategies gain not just immediate financial benefits, but also greater sustainability and independence in an increasingly challenging marketplace.

The future belongs to providers who recognize that contracts and negotiations deserve the same strategic attention as clinical excellence. After all, fair reimbursement is what makes continued clinical excellence possible.

Want more revenue from contract negotiations? Get a demo now.