Data-powered payer contract

negotiation services

Healthcare providers like you deserve fair compensation for the quality

care you deliver. Our contract negotiation services help you secure the

reimbursement rates you've earned, with an average increase of 15.5%

for our clients. While negotiation is just one part of effective contract

management, it's where the most meaningful impact on your revenue

is made.

Trusted in all 50 states

We work with healthcare providers in all 50 states,

leveraging peer benchmarking, data-driven insights, and

advanced analytics for fair, strategic payer agreements.

- Declining insurance reimbursement rates while healthcare costs continue to rise

- Up to 300% disparity in rates for identical services across different payers

- Limited time and resources for practice management teams to effectively negotiate complex insurance contracts

- Lack of market data needed to make compelling cases for increases

- Missing leverage opportunities due to inadequate preparation for payer negotiations

These challenges make it difficult to secure the reimbursement rates providers deserve, putting practice profitability and sustainability at risk.

Successful healthcare payer contract negotiations require preparation, strategy, and leverage. Without a structured approach to payer negotiations, even the most valuable healthcare practices leave money on the table.

Reimbursement Rates

Increase payments for your highest-volume CPT codes, adjust conversion factors, and modify multiple procedure payment reductions that impact your bottom line.

Payment Terms

Reduce payment timeframes, add interest penalties for late payments, and extend claims management submission deadlines to improve cash flow.

Contract Language

Eliminate unfavorable clauses, modify prior authorization requirements, and strengthen appeal processes to reduce administrative burden.

Network Participation Benefits

Secure better network positioning, reduce exclusivity requirements, and negotiate favorable policies.

Quality Incentives

Structure performance metrics that align with your strengths, implement achievable bonus thresholds, and create favorable risk adjustment factors for your healthcare revenue cycle.

Administrative Simplification

Streamline provider credentialing processes, simplify documentation requirements, and standardize claim submission procedures.

Specialized Services

Establish appropriate reimbursement for unique equipment, new service lines, and high-cost items or medications for specialty groups.

Specialized Expertise

Unlike general consultants, we specialize in optimizing payer contracts and negotiating better reimbursement rates with insurance companies. Our team knows when to push and when to compromise—balancing assertiveness with tact. While payers often overcomplicate the process to wear you down, we stay the course, bringing the energy and persistence to see negotiations through, no matter how long they take.

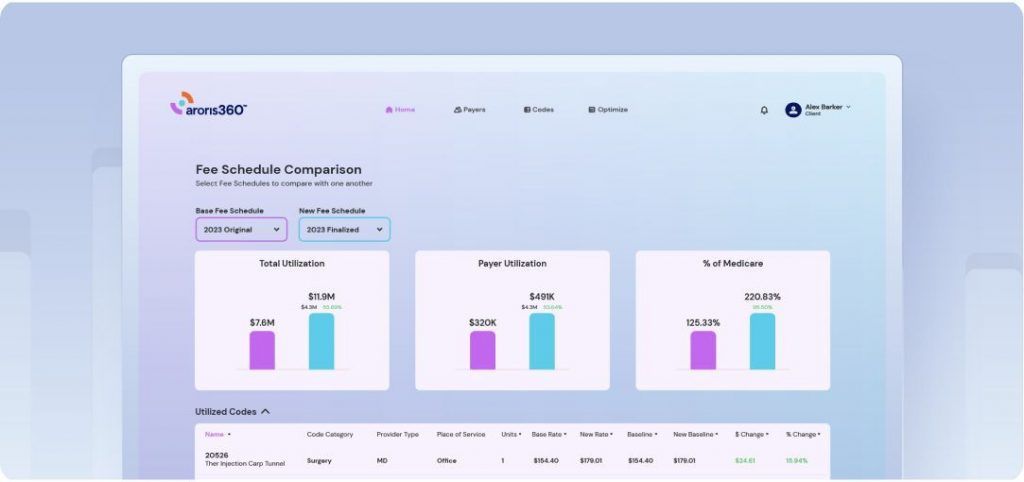

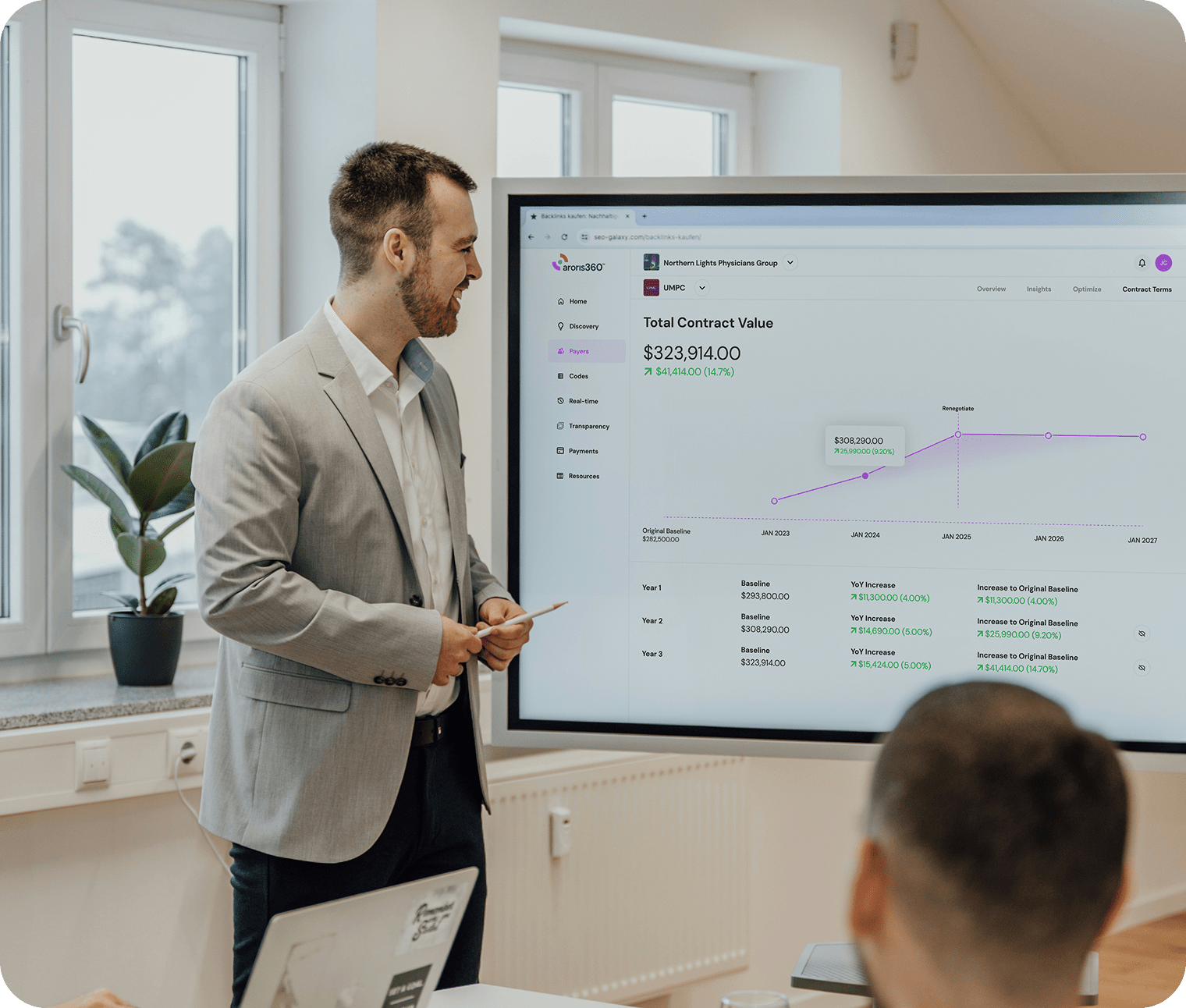

Proprietary Data Analytics

Data is the cornerstone of successful negotiations, and our analytics platform ensures you have the strongest position possible. Most practices operate without access to fair market benchmarks, leaving them at a significant disadvantage. We illuminate your place in the competitive landscape and leverage this intelligence to secure better terms that reflect your true valuea

Proven Process

Our structured approach to contracts and negotiations has delivered consistent results across 130+ medical practices nationwide, with an average 2025 contract increase of 15.5%—significantly outperforming the industry average of 2-4%. This standardized yet customizable methodology addresses each payer’s unique characteristics while maintaining a strategic framework for success.

Performance-Based Payment Model

We put skin in the game by tying our fees directly to the incremental revenue we generate for your healthcare organization. If we don’t increase insurance reimbursements by at least $30,000, we refund 100% of our discovery fee. This model enables practices of all sizes to pursue increased revenue without financial risk, creating a true partnership where we succeed only when you do.

Our negotiators bring unmatched experience from both sides of the table:

- Former payer executives who understand insurer decision-making processes

- Healthcare data analysts specializing in reimbursement benchmarking

- Contract attorneys with deep healthcare regulatory knowledge

- Practice management specialists who understand your operational challenges

We maintain the industry’s largest database of payer contacts and decision-makers, allowing us to navigate complex organizations efficiently and reach the people who can approve meaningful changes.

Healthy Payer Relationships

Aroris strengthens your relationships with payers.

With persistence and professionalism, we tap into our robust network of payer connections to facilitate productive engagements.

Start maximizing your

reimbursement revenue today

FAQ

Have questions? Aroris

has the answers.

Don’t see your question? Ask an Aroris representative.