Healthcare providers consistently focus on optimizing revenue cycle components like billing and collections, yet many overlook one of the most fundamental elements: payer enrollment. The complexity and strategic importance of enrollment management has led many successful practices to partner with specialized payer enrollment services rather than handle this critical function internally.

While credentialing gets most of the attention, enrollment serves as the gateway to reimbursement and directly impacts your ability to negotiate favorable contract terms. Understanding when and why to utilize payer enrollment services can mean the difference between maximizing revenue and leaving money on the table. This guide will help you understand when partnering with payer enrollment services makes financial sense for your practice.

What is payer enrollment and why it matters

Payer enrollment and credentialing are often confused, but they serve distinct purposes in the provider-payer relationship. Credentialing verifies your qualifications and professional standing, while enrollment establishes your eligibility to receive payments from specific insurance plans. Think of credentialing as getting your license to practice, and enrollment as getting your key to the payment system.

The connection between enrollment status and payment eligibility is absolute. Without proper enrollment, you cannot bill for services, regardless of how qualified you are or how excellent your care. This binary relationship makes enrollment status a critical factor in revenue optimization and contract negotiations.

The revenue impact of enrollment issues

The cost of enrollment delays creates immediate and measurable financial impact that extends far beyond administrative inconvenience. When enrollment gaps occur, practices experience significant revenue interruptions during the resolution period, with delays typically lasting several months while issues are resolved. For example, a practice generating $100,000 monthly in revenue from a specific payer could lose $300,000 in cash flow during a three-month enrollment delay.

- Cash flow loss: Enrollment problems create financial consequences that extend beyond immediate payment delays. Revenue loss compounds when enrollment delays coincide with contract negotiation cycles.

- Losing leverage: If your enrollment lapses during a contract renewal period, you lose leverage in rate discussions. Payers have little incentive to offer favorable terms to providers who aren’t currently enrolled and generating claims volume.

- Reputation impact: The ripple effects extend throughout your revenue cycle. Poor enrollment management signals operational weakness to payers, potentially affecting their perception of your practice’s stability and reliability. This reputation impact can influence future contract negotiations and partnership opportunities.

The enrollment process: What actually happens behind the scenes

Professional payer enrollment services follow a structured process that eliminates guesswork and reduces delays. The enrollment process involves multiple steps that must be completed in sequence:

Initial application submission with supporting documentation

Enrollment services prepare comprehensive applications, ensuring all required fields are completed accurately and all supporting documents are included before submission.

Payer review and verification process

Payers review and verify the information, often requesting additional documentation. Experienced enrollment services anticipate these requests and proactively provide additional materials.

Processing and provider identifier assignment

Once verified, payers process the enrollment and assign provider identifiers necessary for billing and reimbursement.

Timeline expectations

Professional enrollment services set realistic expectations based on actual processing times rather than payer estimates. While payers may quote 30-day processing times, experienced services plan for:

- 60-90 days for straightforward cases

- 120-180 days for complex situations involving multiple locations or specialties

Common bottlenecks and how services address them

Enrollment services recognize bottlenecks occur at predictable points and build strategies to minimize delays:

- Incomplete applications: Services conduct thorough reviews before submission, preventing payers from returning applications for correction

- Documentation verification delays: Experienced services maintain relationships with verification sources and follow up proactively to expedite responses

- System processing delays: Services monitor payer processing volumes and adjust submission timing to avoid peak periods when possible

Documentation Requirements

Enrollment services maintain current knowledge of payer-specific requirements, but several categories appear consistently across most payers:

- Professional licenses

- Malpractice insurance certificates

- Hospital privileges

- Tax identification numbers

- Practice location certificates

- Billing service agreements

- Educational credentials

- Board certifications

- Professional references

Quality enrollment services maintain organized systems for tracking and updating these documents, ensuring renewals and updates happen seamlessly without enrollment disruptions.

Common enrollment mistakes that cost money

- Incomplete applications create the most frequent and preventable delays. Payers reject applications with missing information rather than processing them partially, restarting the entire timeline. Common omissions include unsigned forms, missing supporting documentation, and incorrect provider information.

- Missing renewal deadlines and re-enrollment requirements results in enrollment lapses that immediately halt payments. Unlike credentialing, which typically provides advance notice, enrollment renewals often have shorter notification periods and stricter deadlines. Missing these deadlines can create payment interruptions while re-enrollment processes.

- Failure to understand payer-specific requirements. Payer-specific requirements vary significantly, and failing to understand these nuances causes delays and complications. Some payers require additional documentation for specific specialties, while others have unique forms or submission processes. Assuming all payers follow similar procedures leads to repeated application rejections.

- Failure to maintain comprehensive enrollment records across locations. Tracking enrollment status across multiple entities becomes complex for practices with multiple locations, specialties, or legal structures. Each entity may require separate enrollments, and coordinating these requirements demands systematic tracking. Failure to maintain comprehensive enrollment records creates gaps that interrupt revenue flow.

How enrollment status affects your negotiating power

Enrollment status directly impacts your ability to negotiate contracts for favorable terms with payers. Understanding these dynamics helps you leverage enrollment strategically:

Payers review provider enrollment status in negotiations

Enrolled providers represent active, revenue-generating relationships that payers want to maintain. An enrolled provider with consistent claims volume demonstrates value to the payer’s network and member base, providing tangible evidence of your practice’s contribution to their business.

Network participation correlates with higher reimbursement rates

Providers with broader network participation often qualify for higher reimbursement tiers, as they offer greater accessibility to payer members. Limited network participation can restrict your access to premium rate structures that reward comprehensive coverage.

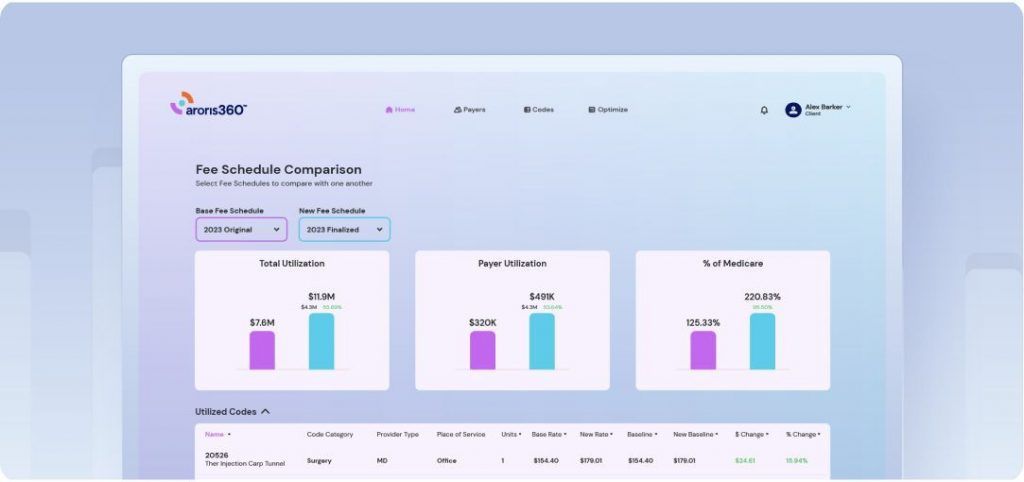

Enrollment data supports rate increase requests

Claims volume, geographic coverage, and specialty services all become stronger negotiating points when supported by robust enrollment data. This information helps justify rate increases based on tangible business value rather than abstract arguments.

Strategic enrollment positioning leverages network gaps

When you understand payer network needs and gaps, you can position your enrollment strategically. If a payer lacks coverage in your specialty or geographic area, your enrollment becomes more valuable, and this scarcity can translate into improved contract terms and higher reimbursement rates.

Proactive vs. reactive enrollment: A strategy for revenue optimization

Most practices handle enrollment reactively—responding to crises, scrambling to meet deadlines, and missing revenue opportunities. Professional payer enrollment services transform this approach into a proactive revenue optimization strategy that maximizes reimbursement potential and strengthens negotiating power.

The reactive approach: Costly and inefficient

Reactive enrollment management creates substantial burdens and missed opportunities:

- Crisis-driven responses: Staff scramble to resolve enrollment lapses after payment disruptions occur

- Resource drain: Enrollment management demands consistent attention from trained personnel who understand payer-specific requirements and can monitor renewal schedules

- Technology gaps: Tracking enrollment status and renewals across multiple payers requires systematic approaches that most practices lack

- Missed deadlines: Without proactive systems, practices frequently miss renewal deadlines, creating payment interruptions

The proactive advantage: Strategic revenue optimization

Professional enrollment services deliver proactive strategies that directly impact your bottom line:

- Tracking systems: Monitor provider enrollment dates, renewal requirements, and documentation deadlines across all payers with advance notifications well before renewal deadlines

- Automation capabilities: Pre-populate applications with stored provider information to reduce data entry errors and organize required documentation

- Integration requirements: Connect enrollment data with contract management systems for comprehensive oversight of payer relationships

- Accountability systems: Ensure enrollment tasks receive appropriate attention with clear procedures for monitoring progress and escalating issues

Why outsourcing often makes financial sense

The cost-benefit analysis typically favors outsourcing when you consider both direct costs and opportunity costs:

Technology advantages of enrollment services:

- Established systems: Professional services already have the tracking, automation, and integration capabilities that would cost practices significant money to develop internally

- Ongoing updates: Services maintain current technology and adapt to changing payer requirements without requiring practice investment

- Scalability: Services can handle enrollment for multiple providers and locations without practices needing to expand their technology infrastructure

Expertise and efficiency benefits:

- Specialized knowledge: Services maintain current understanding of payer-specific requirements and have established relationships with payer enrollment departments

- Process optimization: Experienced services prevent enrollment delays that could cost practices more than the outsourcing expense

- Resource allocation: Outsourcing frees internal staff for other revenue-generating activities while ensuring enrollment receives expert attention

What to look for in enrollment service providers

When evaluating payer enrollment services, prioritize providers who offer:

- Comprehensive technology platforms: Look for services with robust tracking, automation, and reporting capabilities

- Transparency and control: Establish clear communication protocols and regular reporting that allow you to monitor application status, upcoming renewals, and potential issues

- Proven experience: Choose providers who demonstrate experience with your specific payer mix and specialty requirements

- Integration capabilities: Ensure the service can provide the visibility and reporting you need to maintain oversight of your enrollment portfolio

The decision ultimately comes down to whether your practice can cost-effectively build and maintain the technology infrastructure and specialized expertise required for successful enrollment management, or whether partnering with a service provider offers better financial returns and reduced operational complexity.

Maximizing revenue through strategic enrollment management

Effective payer enrollment management extends far beyond administrative compliance—it serves as a foundation for revenue optimization and strategic practice growth. The financial impact of enrollment delays, combined with the technology and expertise requirements for successful management, makes partnering with specialized payer enrollment services a clear business decision for most practices. When enrollment activities align with the contract negotiation process and strategic planning through professional services, they contribute directly to sustained revenue growth and enhanced negotiating power in an increasingly complex healthcare landscape.