Your claim was paid—but was it paid correctly?

Most medical practices celebrate when claims come back paid instead of denied. But here’s the problem: a paid health insurance claim isn’t necessarily a correctly paid claim. Thousands of dollars slip through the cracks every month because claims are processed at rates below your contracted agreements.

While your team focuses on fighting claim denials, underpayments quietly erode your revenue without triggering a single alert in your practice management system.

This gap between what your payer contracts promise and what you actually collect represents one of the most overlooked aspects of healthcare contract management, directly impacting the sustainability of your practice.

What Are Underpaid Claims?

An underpaid claim is one that a payer processes and pays, but at a rate lower than what your contract stipulates.

Unlike a denial—which stops payment entirely and forces you to take action—an underpayment looks like success in your system. The claim shows as “paid” in your reporting. Your staff moves on to the next task. And you never recover the difference.

The distinction matters because underpayments operate in a gray zone that traditional claims management services aren’t designed to catch. Your billing team is trained to appeal denials, but how often do they verify that every paid claim matches your contracted rate? In a practice processing hundreds or thousands of claims monthly, that level of scrutiny simply isn’t feasible manually.

Over time, these small discrepancies compound. A $15 underpayment here, a $47 underpayment there—it doesn’t seem significant until you realize it’s happening on 3-5% of your claims, month after month. That’s when practices discover they’ve lost tens of thousands of dollars to errors they never knew existed.

Why Underpaid Claims Go Undetected

The volume problem is the first hurdle.

A typical practice doesn’t have the staff capacity to cross-check every Explanation of Benefits (EOB) against contract terms. Even if you wanted to, you’d need someone who understands the nuances of every payer contract, knows the correct rate for every CPT code, and has time to manually verify hundreds of payments each week.

Then there’s the timing issue.

By the time you spot an underpayment during a quarterly audit or random review, you may have already blown past the filing deadline for appeals. Most payers give you 90-180 days to dispute a payment. Miss that window, and the underpayment becomes permanent lost revenue.

Contract complexity makes the problem worse.

You’re not managing one fee schedule—you’re juggling dozens of payer agreements, each with different rates, different modifier rules, and different bundling logic. These contracts change. Payers update fee schedules. Without a centralized system tracking these updates against actual payments, there’s no way to know if you’re being paid correctly.

Your billing team’s bandwidth is the final constraint.

They’re already handling denials, patient collections, prior authorizations, and eligibility verification. Adding systematic payment verification to that administrative burden isn’t realistic. Something has to give, and payment verification usually loses.

The True Cost of Underpayments

Underpayments don’t just represent one claim paid wrong—they often signal systematic processing errors that affect multiple claims over time. When a payer incorrectly loads your fee schedule into their system, every claim for that service gets underpaid until someone notices and forces a correction. That could be weeks or months of consistent underpayments.

Once the timely filing deadline passes, that revenue is gone permanently. The payer has no obligation to correct the error retroactively. This makes underpayments fundamentally different from denials, which typically give you multiple chances to appeal and resubmit.

There’s also an opportunity cost. Every hour your staff spends on other revenue cycle tasks is an hour they’re not catching underpayments.

Without automated systems, you’re forced to make trade-offs: chase denials or verify payments? Work on patient collections or audit EOBs? Most practices choose the squeaky wheel—denials and patient complaints—while underpayments accumulate silently.

Perhaps most importantly, unchecked underpayments erode the integrity of your contracted rates. If payers can consistently pay below contract without consequence, what incentive do they have to process claims correctly? Vigilant monitoring sends a message: we notice, we track, and we appeal discrepancies. That accountability protects your revenue long-term.

Common Scenarios Leading to Underpayment

Understanding how underpayments happen helps you know what to look for. Here are the most frequent culprits:

1. Incorrect fee schedules

The payer loads the wrong fee schedule into their system—perhaps using last year’s rates instead of the current contract. Every claim gets underpaid by the difference.

2. Modifier misinterpretation

Your documentation supports a modifier that increases reimbursement, but the payer’s system strips it during processing or fails to apply the correct rate adjustment.

3. Inappropriate bundling

The payer bundles two separately billable services when your contract allows separate payment. This typically happens with E&M services billed on the same day as procedures.

4. Partial denials disguised as adjustments

A payer reduces payment without issuing a formal denial, making it look like a standard contractual adjustment rather than a dispute-worthy underpayment.

5. Downcoding without notification

The payer pays at a lower-level code than you billed, without proper documentation review or notification that they’ve changed the code.

Each of these scenarios is recoverable—if you catch it in time.

How to Identify Underpaid Claims

Manual verification requires a systematic approach. You start by pulling all EOBs for paid claims and comparing the allowed amount against your contract rate for each CPT code. Factor in any applicable modifiers that should increase reimbursement. Check whether the payer applied the correct provider type rate (physician vs. non-physician practitioner often have different fee schedules).

Look for patterns. If multiple claims for the same service are consistently coming back at the same incorrect rate, that’s likely a systematic error worth appealing. Random one-off discrepancies might not be worth the administrative cost to pursue, but systematic errors represent significant recovery opportunities.

Build a verification workflow if you’re doing this manually: designate someone to audit a sample of paid claims each week, focusing on your highest-volume or highest-reimbursement services. Track what you find. Document underpayment patterns. Use that data to decide where to focus deeper audits.

The challenge with this approach is sustainability. Manual verification is time-intensive and error-prone. You can catch some underpayments, but you’ll never catch them all. And you won’t catch them fast enough to stay within appeal deadlines on every claim.

Automated Payment Verification: A Smarter Approach

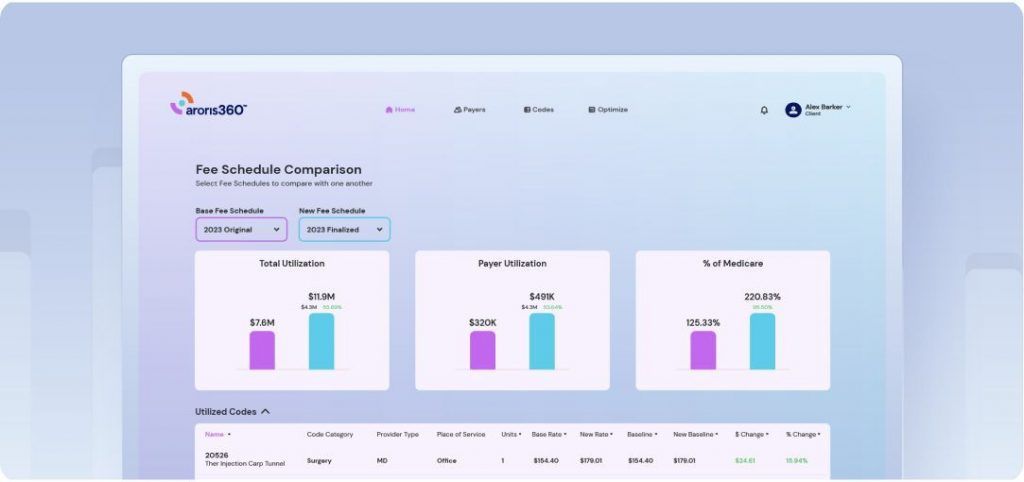

This is where contract management software changes the equation. Live claims monitoring tracks every claim as it processes through payer systems, comparing actual payments against your contracted rates in real-time. Instead of discovering underpayments weeks or months later during a manual audit, you get immediate alerts the moment a payment falls below contract.

The system maintains an updated database of your contract terms for every payer, every CPT code, and every modifier combination. When the EOB comes back, the software automatically verifies the payment is correct. If not, it flags the discrepancy for review while you’re still well within the timely filing window for appeals.

This real-time approach solves the timing problem. You’re not racing against deadlines because you’re catching underpayments immediately. It solves the volume problem because automation can verify thousands of claims without adding staff. And it solves the complexity problem by centralizing all your contract terms in one system that updates as contracts change.

When evaluating claims monitoring technology, look for these capabilities:

Contract rate database integration

The system needs current rates for all your payers, updated automatically when contracts change.

Claim-level verification

Every claim should be checked, not just a sample. The goal is comprehensive coverage.

Intelligent alerting

You want notifications that prioritize by dollar value and urgency, not just a flood of every minor variance.

Appeals workflow tools

Identifying underpayments is only half the battle. The system should help you document and submit appeals efficiently.

Pattern recognition reporting

Look for technology that surfaces trends—like a particular payer consistently underpaying certain codes—so you can address systematic issues.

Taking Action on Underpaid Claims

Once you’ve identified an underpayment, act quickly. Most payers require written appeals that include the original claim, the EOB showing incorrect payment, and documentation of your contracted rate. Some payers have specific appeal forms; others accept letters on practice letterhead.

Be specific in your appeal. Reference the exact contract provision that supports your contracted rate. Include the CPT code, date of service, patient name, and claim number. State clearly what you were paid versus what you should have been paid, and request the difference.

Track your appeals systematically. Note the date submitted, payer response time, and outcome. This data helps you understand which payers are responsive versus which ones require escalation. It also helps you measure your recovery success rate.

If initial appeals fail, escalate. Many payers have secondary review processes. Provider relations representatives can often resolve systematic issues faster than formal appeals. And in cases where multiple claims are affected by the same error, you may be able to negotiate a bulk correction that addresses all impacted claims at once.

Use underpayment data strategically during contract negotiations. If you can demonstrate that a payer consistently processes claims incorrectly, that’s leverage for better terms or more favorable language around payment dispute resolution.

Protecting Every Dollar You Earn

Underpaid claims represent preventable revenue loss. They’re not the result of poor documentation or untimely filing—they’re processing errors that you have every right to correct. But you can only correct what you catch.

Manual oversight works for small-scale verification, but it doesn’t scale to catch every underpayment across thousands of claims. The gap between what’s possible manually and what’s necessary to protect your revenue is where automated monitoring makes the difference.

The practices that recover the most from underpayments aren’t necessarily the ones with the largest billing departments. They’re the ones with systems in place to verify every payment automatically, flag discrepancies immediately, and maintain appeals while the window is still open.

Your contracted rates reflect hard-won negotiations. Automated payment verification ensures you actually receive what you’ve earned. Because a paid claim should mean a correctly paid claim—every single time.