Financial sustainability in healthcare hinges on more than just providing excellent patient care. The revenue cycle in healthcare ensures organizations receive timely and accurate reimbursement for their services. At the heart of this critical process lie payer contracts—agreements that fundamentally determine how, when, and how much healthcare providers get paid.

As healthcare costs continue to rise and reimbursement models evolve, understanding the intricate relationship between revenue cycle management and payer contracts has never been more crucial for healthcare organizations seeking financial stability and growth.

What is the Revenue Cycle in Healthcare?

The revenue cycle in healthcare is made up of all administrative and clinical functions that contribute to the capture, management, and collection of patient services. From the initial patient visit to final payment, this comprehensive financial process operates in a cycle, with each step building upon the last.

Ultimately, the goal of revenue cycle management is to ensure accurate and timely reimbursement for healthcare services that a practice provides.

Key Steps in the Revenue Cycle Process

Front-End Processes (Pre-Service):

The revenue cycle begins with patient registration and scheduling, where healthcare organizations collect demographic and insurance information. This step is crucial for ensuring the practice has accurate and up-to-date information necessary for treatment, billing, and reporting.

Insurance verification follows as the next critical step. It’s important for providers to know that patients have active insurance policies and understand coverage terms, since this directly impacts reimbursement amounts and helps prepare patients for out-of-pocket costs.

Mid-Cycle Processes (During Service):

Medical coding takes clinical documentation and turns it into standardized codes for billing purposes. This process involves translating medical procedures, diagnoses, and services into codes and may be done manually by medical coders or automated through healthcare IT platforms.

Charge entry involves inputting coded information into billing systems. Proper charge entry helps reduce the risk of claim denials, underbilling, or overbilling.

Back-End Processes (Post-Service):

Claims submission to insurance providers typically occurs electronically through revenue cycle management platforms. Submitting accurate, clean claims helps the revenue cycle tremendously because claims are typically approved the first time, shortening the overall cycle and improving the bottom line.

Payment posting and reconciliation involves recording and comparing payments received against expected amounts. These processes are crucial for maintaining accurate financial records and ensuring all payments are properly accounted for.

Finally, denial management and appeals address rejected claims, while patient collections handle remaining balances.

How Healthcare Providers Generate Revenue

Healthcare organizations rely on multiple revenue streams. Insurance reimbursements from commercial payers, Medicare, and Medicaid represent the largest portion of most providers’ revenue. Patient payments include co-payments, deductibles, and self-pay amounts, while government programs provide additional funding.

The Evolution of Payment Models

Traditional fee-for-service models are increasingly becoming less common, while value-based care arrangements take over. The shift toward value-based care models is reshaping revenue cycle management, with healthcare organizations expected to track not just services rendered, but patient outcomes and quality metrics.

Bundled payments and capitation models are also gaining traction as healthcare systems seek to control costs while improving outcomes. The shift from fee-for-service models to value-based care aims to enhance patient outcomes and reduce healthcare costs by tying provider reimbursement to the quality of care provided.

How Payer Contracts Play a Critical Role in Revenue Cycle

Payer contracts serve as the fundamental framework that governs the financial relationship between healthcare providers and insurance companies. These agreements define payment terms and rates, establish covered services, and set administrative procedures that directly impact every aspect of the revenue cycle.

Payer contracting is the backbone of negotiations between healthcare organizations and insurance companies, setting the terms for service provision and payment with profound impact on financial stability, quality of patient care, and overall patient satisfaction.

Impact on Financial Performance

The direct relationship between payer contracts and revenue cannot be overstated. Contract terms determine reimbursement rates, which directly affect cash flow and operational efficiency.

Effective payer contracts must address multiple components including reimbursement methodologies, payment timelines, quality metrics, performance requirements, and network participation terms. Each element is critical in the financial success of the provider-payer relationship.

Challenges of Optimizing Payer Contracts

Negotiation Challenges

Healthcare providers often face resistance from payers who aim to minimize reimbursement rates. Payers have significant leverage at the bargaining table, enhanced by payer consolidations and the emergence of dominant local, regional and national plans.

Current Market Dynamics

As providers face higher costs and increased payer denials, payers are facing higher medical costs, resulting in increasingly contentious contract negotiations between the two sides. The typical health system needs a rate increase of 5% to 8% each year across all payers to break even by 2027, but providers typically only see 1% to 3% increases over multi-year contracts.

Rising costs driven by cybersecurity and regulatory compliance demands, along with increasing patient bad debt rates, are creating additional financial pressures. Workforce challenges in a competitive labor market further complicate contract management efforts.

Specific Contract Management Issues

Many healthcare organizations struggle with contract sprawl across multiple payer relationships, manual tracking processes, and lack of visibility into contract performance. With insufficient staff to tackle contract management, 17% of providers let contracts languish for years according to an MGMA poll.

Benefits of Optimizing Payer Contracts

Financial Benefits

Effective payer contract optimization delivers significant financial returns through improved reimbursement rates, reduced claim denials, faster payment cycles, enhanced cash flow, and increased net revenue. Engaging in payer contract negotiations allows healthcare organizations to have more favorable reimbursement rates and avoid financial strain from contracts that don’t adequately cover service costs.

Operational and Strategic Benefits

Beyond immediate financial gains, optimized contracts streamline administrative processes, improve staff efficiency, enhance compliance, and create better negotiating positions for future renewals. Adequate reimbursement rates also allow providers to reinvest in their practice, enhancing the quality of care offered to patients.

Contract Negotiation Best Practices

Preparation is Key

Providers should start preparing at least 12 months before contract renewal dates, gathering data on current reimbursement rates, analyzing payer performance, and understanding market trends. Set a bargaining range that includes an optimum, minimum, and target goal.

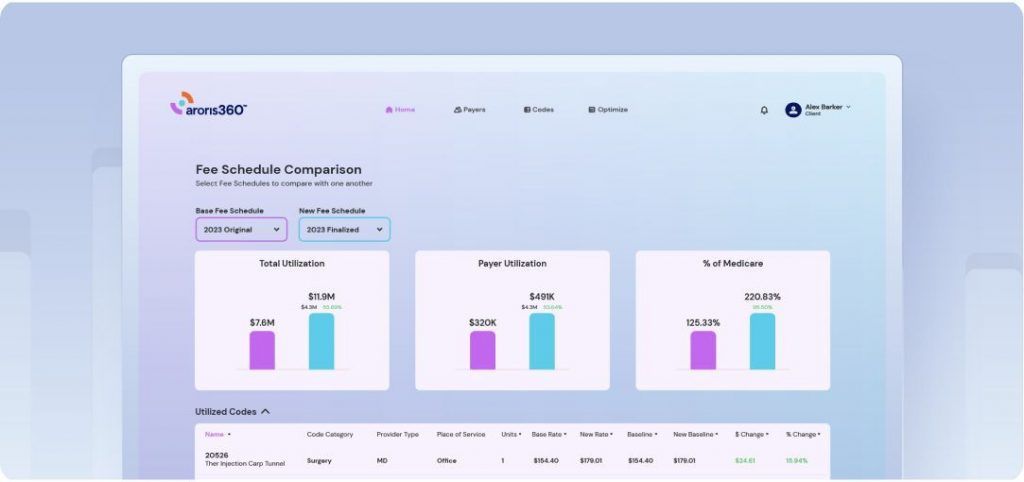

Data-Driven Negotiation Strategies

By adopting a transparent data-driven strategy in negotiations with a payer, provider organizations can create opportunities for building strong partnerships based on mutual respect and understanding. Use de-identified data to compare payer performance and build strong cases for rate adjustments, focusing on securing higher rates for high-volume services.

Strategic Approach

Contract negotiations should be about the entire relationship with the payer, not just painting themselves as wanting “more money,” but putting all payer issues on the table including concerns about claim processing, denial rates, and administrative burden.

Looking Forward: The Future of Revenue Cycle Management

AI and automation are becoming indispensable in improving revenue cycle management efficiency, with artificial intelligence assisting in coding, claims management, and denial prevention.

Additionally, the move away from fee-for-service toward value-based care models is reshaping revenue cycle management, with healthcare organizations expected to track not just services rendered, but patient outcomes and quality metrics. As value-based contracts become more common and PBM consolidation continues, managing payers and providers has become increasingly complex.

Conclusion

Payer contracts represent the foundation of healthcare revenue and play a critical role in financial sustainability. In an era of rising costs, increasing regulatory complexity, and evolving payment models, healthcare organizations cannot afford to treat contract management as a passive process.

Healthcare organizations aiming to claw back margin must focus on reducing administrative waste, especially as it relates to revenue cycle and collecting monies owed for services they render.

Organizations that master payer contracting through proactive management, comprehensive data analysis, and strategic negotiation will be best positioned to thrive in the value-based care era. The evolving healthcare landscape demands nothing less than excellence in revenue cycle management, with payer contracts serving as the cornerstone of financial success.