Frequently Asked Questions

Healthcare providers have important questions about payer contract

optimization and negotiation. We've compiled answers to the

most common concerns we hear from practice administrators, CFOs, and

healthcare executives considering our services.

Can't find what you're looking for? Contact our team and we'll get

you the answers you need.

What data sources do you integrate with?

Our platform brings in data from:

- Major EHR, RCM, PM, and billing systems via secure integrations

- Payer-provided data and claims feeds

- Publicly available transparency data (e.g., CMS datasets)

- Clearinghouses and other third-party sources

We work with you to ensure our integrations are tailored to your existing workflows and technology stack.

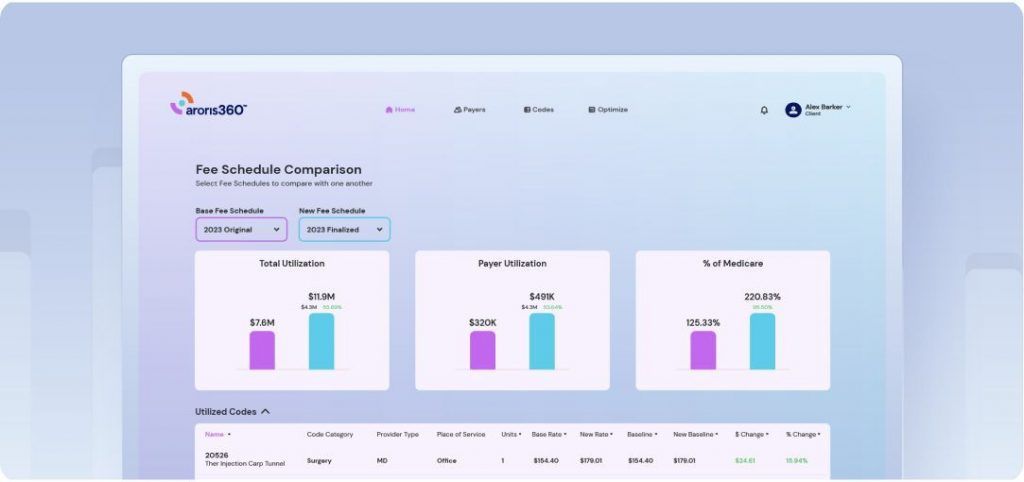

What kind of insights can I get from the platform?

Can you provide an example?

You’ll gain actionable information about payer performance, reimbursement trends, and contract benchmarks. For example, if you’re negotiating with a specific payer, our platform can show you how your contracted rates compare to regional or specialty-specific benchmarks, highlighting where you’re underpaid or where there’s an opportunity to improve terms.

Does Aroris360 replace my current RCM/EHR/PM or billing system?

No, our solution is designed to complement, not replace, your existing systems. We integrate with your RCM, EHR/PM, or billing software to enhance data visibility, contract optimization, and negotiation strategies. You can keep using your current tools while leveraging our platform’s analytics and insights.

How long does it take to implement the platform?

Most practices can complete the implementation process in 4-8 weeks. This includes data integration, user setup, and training. Larger networks may require a bit more time, but we tailor the timeline to your needs.

What's included in the implementation fee?

The implementation fee covers data setup, integration, user training, and comprehensive onboarding support to ensure a seamless transition to our platform. This also includes your comprehensive contract analysis and strategy development during the discovery phase.

Are there any hidden fees?

No. We believe in full price transparency. Your subscription covers platform access, standard support, and implementation (if applicable). If there are ever additional costs—such as advanced custom reports or add-on features—they will be clearly explained in advance, so you can decide whether to opt in.

Do you offer custom pricing for larger groups or networks?

Yes. For larger groups, such as a 30-TIN ASC network or multi-location practices, we provide custom pricing tailored to your specific size and scope. Reach out to our sales team to discuss options that accommodate your network’s needs and budget.

Do you offer only annual subscriptions?

We offer both annual subscriptions and flexible shorter-term options. If you only need the platform for a specific negotiation period, you can opt for a month-to-month plan. However, many clients choose our annual subscription for the cost savings and ongoing data insights that help with continuous payer negotiations throughout the year.

Which plan is best for my practice size and needs?

Each plan is designed to scale with your needs. The Essential plan is great for foundational insights, the Advanced plan adds benchmarking and competitive data, and the Premium plan offers full contract optimization and payment analysis. Our team can help you determine the best fit based on your practice size and goals.

Can I switch plans later?

Yes! You can upgrade to a higher-tier plan at any time to unlock additional features and insights.

How does the 30-day trial work?

You get full access to your selected plan’s features for 30 days. If you decide it’s not the right fit, you can cancel before the trial ends with no commitment.

What kinds of customer support can I expect?

Our standard customer support includes:

- Phone and email support during regular business hours

- Guaranteed response times (within 24-48 hours)

- Dedicated account manager for larger or enterprise clients

If you require 24/7 or expedited support, we offer custom support packages to ensure your team always has the help they need.

What's the difference between Contract Optimization and Expert Negotiation?

Contract Optimization is our comprehensive analysis service where we digitize your payer contracts into the Aroris360 platform, review all terms and fee schedules, and provide detailed recommendations for improvement. You receive a complete audit identifying opportunities but handle negotiations yourself.

Expert Negotiation goes further — our team conducts the actual negotiations with payers on your behalf using data-driven cases built from our proprietary benchmarking database. This is where we achieve the revenue increases that justify our performance-based fees.

Many clients choose both services for maximum impact.

What documents do I need to provide to get started?

During our discovery phase, we’ll need:

- Current payer contracts and fee schedules

- Tax ID numbers and practice information

- Letter of Authorization (LOA) to negotiate on your behalf

- 12 months of transaction/claims data

- Chargemaster information

Our team verifies all documents directly with payers before analysis begins, ensuring accuracy from day one.

How long does the entire process take?

Our typical timeline breaks down as follows:

- Discovery Phase: 8-12 weeks (document collection and verification)

- Analysis & Strategy: 2 weeks (comprehensive review and planning)

- Negotiations: 4-8 weeks per payer (varies by complexity)

- Ongoing Optimization: Quarterly reviews and annual planning

Most clients see their first successful rate increases within 4-6 months of starting.

What if you can't achieve the minimum increase you guarantee?

We stand behind our work with a full money-back guarantee. If we cannot successfully negotiate the minimum amount we predetermine in annual revenue increases for your practice, we return 100% of your discovery phase investment.

This guarantee reflects our confidence in both our process and the widespread opportunity for rate improvements across the healthcare industry.

How do you calculate your performance fee?

Our fees are based solely on the incremental revenue we negotiate above your current baseline—never on your existing revenue or collections.

Here’s how it works:

- We establish a baseline using your previous 12 months of volume and current fee schedules

- We calculate the dollar increase value from successful negotiations

- Our fee equals a set percentage of that increase value, spread over 36 months

- You keep the balance of all increases we achieve

Are there any upfront costs besides the discovery fee?

The discovery fee covers our comprehensive analysis and initial strategy development.

For ongoing platform access after your first 12 months free, there’s a monthly fee for up to 4 users. This includes contract management, renewal notifications, and performance tracking through Aroris360.

No other fees apply unless you request additional contract negotiations beyond the initial scope.

Will working with Aroris damage my relationship

with insurance companies?

We work to strengthen understanding between providers and payers, always operating and negotiating in a professional manner. Our approach strengthens rather than strains payer relationships. We never use adversarial tactics or make unreasonable demands. Instead, we:

- Present data-driven cases that demonstrate fair market positioning

- Maintain professional, respectful communication throughout negotiations

- Focus on mutually beneficial outcomes that recognize your value to their network

- Leverage our extensive database of payer contacts and decision-makers

We’ve built positive relationships with payers nationwide precisely because we negotiate professionally and present compelling cases that are hard to argue against.

How does Aroris develop reimbursement rate cases?

First, we invest the time to understand the unique dynamics of each practice’s business. Then, using its proprietary data analytics platform, we analyze reimbursement rate data to establish benchmarks and targets. We convert the data into compelling visuals with clear conclusions to make your case.

Our process involves:

- Deep practice analysis: Understanding your specific business model, patient mix, and market position

- Comprehensive benchmarking: Comparing your rates against regional and specialty-specific data

- Visual case development: Creating clear, compelling presentations that demonstrate fair market positioning

- Strategic positioning: Building arguments that show mutual value for both you and the payer

What if a payer refuses to negotiate or

threatens to terminate our contract?

Contract termination is rare and typically represents a lose-lose scenario that payers want to avoid. However, we prepare for all outcomes:

- Risk assessment: We evaluate each payer relationship before negotiations begin

- Strategic prioritization: We focus on contracts with the best opportunity and lowest risk

- Alternative approaches: If direct rate increases aren’t possible, we explore other value-enhancing terms

- Relationship preservation: Our experienced team knows when to push and when to maintain status quo

Remember, payers need quality providers in their networks. If you deliver good care and serve their members well, they have strong incentives to maintain the relationship.

How much of my staff's time will this require?

We minimize disruption to your operations. Most of the work happens behind the scenes with periodic check-ins:

- Initial setup: 2-3 hours for document gathering and introductions

- Discovery phase: Minimal involvement while we collect and verify data

- Strategy review: 1-2 hour meeting to review findings and approach

- Negotiation updates: Brief progress reports, no action required from you

- Ongoing management: Quarterly reviews (30 minutes) and annual planning (1-2 hours)

Our goal is handling the complexity so you can focus on patient care and practice operations.

What training do you provide on the Aroris360 platform?

Every client receives comprehensive Aroris360 training, including:

- Initial walkthrough: Personalized tour of your practice’s data and dashboard features

- User training: Sessions for up to 4 designated staff members

- Ongoing support: Help desk access and regular platform updates

- Best practices: Guidance on using insights for ongoing contract management

The platform is designed for intuitive use, with most users becoming proficient within their first week of access.

Do you handle all communication with payers or do I need to be involved?

We manage all negotiation communication directly with payers. You’ll receive regular updates on progress, but don’t need to participate in day-to-day discussions.

Your involvement is limited to:

- Authorization: Signing letters of authorization for us to negotiate on your behalf

- Final approval: Reviewing and approving negotiated terms before contract execution

- Strategic input: Sharing priorities or concerns that should guide our approach

This hands-off model lets us leverage our payer relationships and negotiation expertise while keeping you informed throughout the process.

What's the typical rate increase you achieve for practices?

Many factors influence the size of a provider’s reimbursement rate increase, like the practice type, location, rate history, and economic conditions. On average, our clients receive approximately a 15.5% rate increase on their payer contracts, significantly higher than the 2-4% industry average. However, results vary based on several factors:

- Current rate positioning: Practices further below market rates often see larger increases

- Payer mix: Some insurance companies are more receptive to adjustments than others

- Geographic market: Regional variations in healthcare costs and competition affect outcomes

- Practice specialty: Certain specialties have more negotiation leverage than others

- Contract timing: Negotiations during renewal periods typically yield better results

We provide realistic expectations based on your specific situation during our discovery phase analysis.

How do you ensure rate increases actually stick long-term?

We build sustainability into every negotiated agreement:

- Contract language review: Ensuring increases are properly documented and enforceable

- Implementation monitoring: Tracking actual reimbursements to confirm payers honor new rates

- Regular audits: Quarterly reviews to catch and address any discrepancies quickly

- Renewal management: Proactive planning for future contract renewal opportunities

- Market tracking: Ongoing analysis to identify when additional negotiations may be warranted

Our ongoing optimization ensures that you continue to benefit from the improvements we negotiate on your behalf.

What if market rates change after we negotiate new contracts?

Healthcare reimbursement is dynamic, which is why we provide ongoing analysis and optimization rather than one-time negotiations.

- Regular benchmarking: We continuously update our market data to track rate changes

- Proactive recommendations: When market shifts create new opportunities, we’ll identify them

- Contract review cycles: Annual assessments help determine when renegotiation makes sense

- Industry insights: We keep you informed of broader trends affecting your specialty or region

How does this platform help improve my revenue?

Our tools provide clear reimbursement insights, payer contract optimization, and benchmarking data to ensure you’re maximizing payments and reducing underpayments. The platform identifies specific opportunities where your rates are below market standards and provides the data needed to build compelling cases for rate increases.

When will we see results?

Many customers begin seeing measurable improvements—such as increased reimbursements or more favorable contract terms—within the first few months. However, exact timelines can vary based on factors like the complexity of your contracts and the frequency of your negotiations.

What's the minimum practice size you work with?

We typically work with practices that have at least $300,000 in annual payer reimbursements per contract we negotiate. This ensures sufficient volume to justify both our engagement and the payer’s attention.

Our retainer arrangements are designed for larger practices. However, smaller practices may still benefit from our Contract Optimization service and Aroris360 platform access.

Do you work with employed physicians or just independent practices?

While we specialize in independent practices and privately-owned medical groups, we can work with employed physicians in certain situations:

- Hospital-employed groups: If you have autonomy over payer contracting decisions

- Management service agreements: Where you maintain control over contract negotiations

- Joint ventures: Partnerships where you have negotiation authority

The key factor is whether you have the authority to negotiate and execute payer contracts. Contact us to discuss your specific situation.

Can you help if I'm already under long-term contracts with payers?

Absolutely. Even if your contracts don’t expire for several years, we can:

- Identify amendment opportunities: Many contracts allow mid-term adjustments under certain circumstances

- Plan for renewals: Develop strategies and gather data for future negotiation cycles

- Optimize existing terms: Review current agreements for favorable clauses you may not be utilizing

- Benchmark positioning: Understand where you stand relative to market rates for future planning

We often begin working with practices years before their contract renewals to ensure we’re fully prepared when opportunities arise.